The 30-year fixed-rate mortgage averaged 3.65% this week, continuing to entice home buyers to the market with cheaper financing opportunities. “By all accounts, mortgage rates remain low and, along with a strong market, are fueling the consumer-driven economy by boosting purchasing power, which will certainly support housing market activity in the coming months,” says Sam Khater, Freddie Mac’s chief economist.

Still, worsening affordability due to inventory shortages continue to present hurdles for the housing market, Khater notes. The National Association of REALTORS® released a study this week showing how high home prices are stymieing job growth in some metro areas.

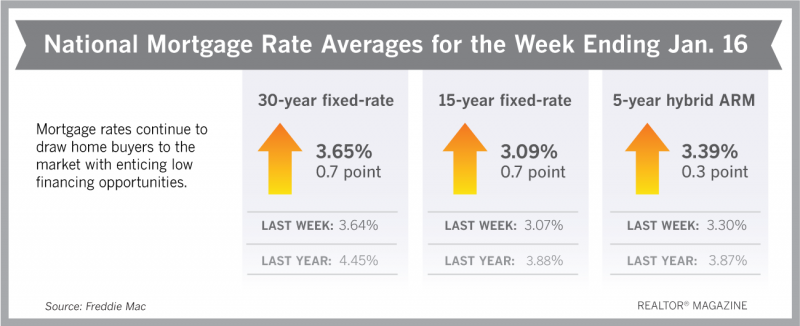

Freddie Mac reports the following national averages with mortgage rates for the week ending Jan. 16:

- 30-year fixed-rate mortgages: averaged 3.65%, with an average 0.7 point, rising slightly from last week’s 3.64% average. Last year at this time, 30-year rates averaged 4.45%.

- 15-year fixed-rate mortgages: averaged 3.09%, with an average 0.7 point, inching up slightly from a 3.07% average. A year ago, 15-year rates averaged 3.88%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.39%, with an average 0.3 point, rising from last week’s 3.30% average. A year ago, 5-year ARMs averaged 3.87%

Source: Freddie Mac