The interest rate for a 30-year fixed-rate mortgage rose to a 2.84% average this week but remains near all-time lows. Last week, the rate for a 30-year fixed-rate mortgage set a record low of 2.78%. “Mortgage rates jumped this week as a result of positive news about a COVID-19 vaccine,” says Sam Khater, Freddie Mac’s chief economist. “Despite this rise, mortgage rates remain about a percentage point below a year ago, and the low-rate environment is supportive of both purchase and refinance demand. Heading into late fall, the housing market continues to grow and buttress the economy.”

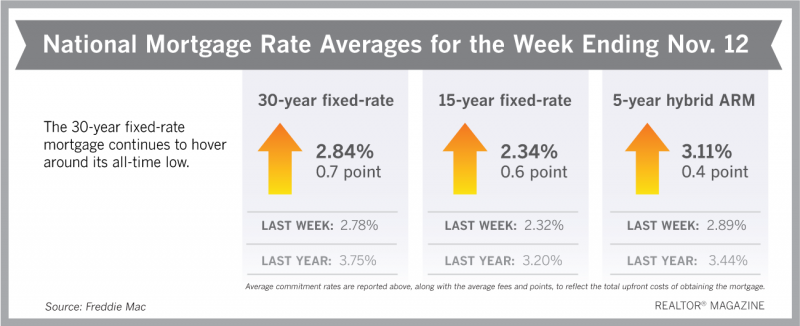

Freddie Mac reports the following national averages with mortgage rates for the week ending Nov. 12:

- 30-year fixed-rate mortgages: Averaged 2.84%, with an average 0.7 point, up from last week’s record 2.78% average. A year ago, 30-year rates averaged 3.75%.

- 15-year fixed-rate mortgages: Averaged 2.34%, with an average 0.6 point, increasing from last week’s 2.32%. A year ago, 15-year rates averaged 3.20%.

- 5-year hybrid adjustable-rate mortgages: Averaged 3.11%, with an average 0.4 point, increasing from last week’s 2.89% average. A year ago, 5-year ARMs averaged 3.44%.

Freddie Mac reports average commitment rates along with points to better reflect the total upfront cost of obtaining a mortgage.

Source: Freddie Mac and National Association of REALTORS®