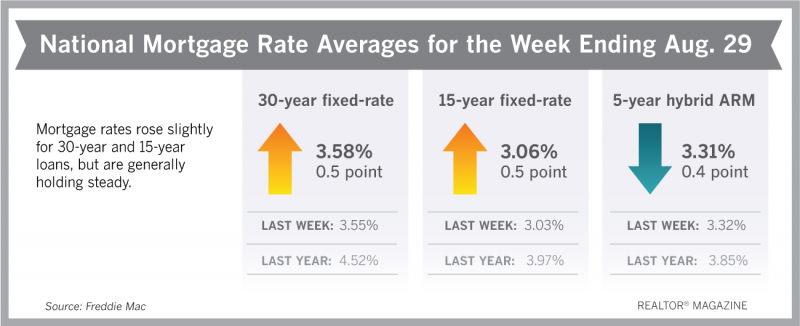

The 30-year fixed-rate mortgage inched up this week, but still remains well below averages from a year ago.

The 30-year fixed-rate mortgage closed the month of August by averaging 3.6%, nearly a full percent lower than a year ago, Freddie Mac notes.

“Low mortgage rates along with a strong labor market are fueling the consumer-driven economy by boosting their purchasing power, which will certainly support housing market activity in the coming months,” says Sam Khater, Freddie Mac’s chief economist.

Freddie Mac reports the following averages with mortgage rates for the week ending Aug. 29:

- 30-year fixed-rate mortgages: averaged 3.58%, with an average 0.5 point, rising from last week’s 3.55% average. Last year at this time, 30-year rates averaged 4.52%.

- 15-year fixed-rate mortgages: averaged 3.06%, with an average 0.5 point, rising from last week’s 3.03% average. A year ago, 15-year rates averaged 3.97%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.31%, with an average 0.4 point, dropping from last week’s 3.32% average. A year ago, 5-year ARMs averaged 3.85%.

Source: Freddie Mac