Mortgage rates jumped dramatically this week but stand to dip some in the near future after the Federal Reserve lowered interest rates Wednesday. The 30-year fixed-rate mortgage rose to a 3.73% average—its largest week-over-week increase since October 2018. However, despite the uptick, rates remain historically low, Freddie Mac reports. So tell your buyers not to panic in the face of this latest hike.

“Despite the rise in mortgage rates, economic data improved this week—particularly housing activity, which gained momentum with a noticeable rise in purchase demand and new construction,” says Freddie Mac Chief Economist Sam Khater. “Home buyers flocked to lenders with purchase applications, which were up 15 percent from a year ago, and residential construction permits increased 12 percent from a year ago to 1.4 million—the highest level in 12 years. While there was initially a slow response to the overall lower mortgage rate environment this year, it is clear that the housing market is finally improving due to the strong labor market and low mortgage rates.”

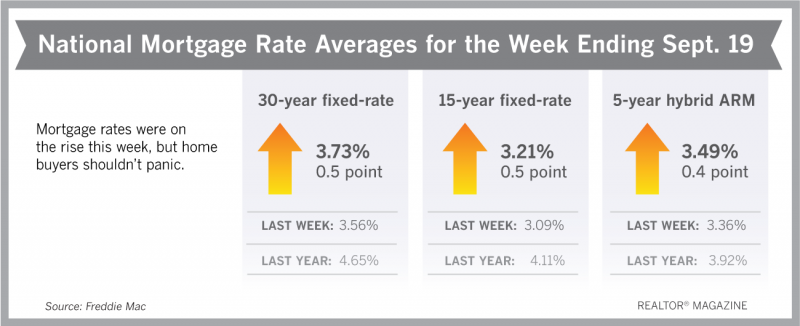

Freddie Mac reported the following national averages with mortgage rates for the week ending Sept. 19:

- 30-year fixed-rate mortgages: averaged 3.73%, with an average 0.5 point, rising from last week’s 3.56% average. Last year at this time, 30-year rates averaged 4.65%.

- 15-year fixed-rate mortgages: averaged 3.21%, with an average 0.5 point, rising from last week’s 3.09% average. A year ago, 15-year rates averaged 4.11%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.49%, with an average 0.4 point, up from a 3.36% average last week. A year ago, 5-year ARMs averaged 3.92%.

Source: Freddie Mac