Borrowing costs inched down for the second consecutive week. The 30-year fixed-rate mortgage averaged 3.33%, Freddie Mac reports.

“Mortgage rates have drifted down for two weeks in a row and that drop reflects improvements in market liquidity and sentiment,” says Sam Khater, Freddie Mac’s chief economist. “While the market has stabilized relative to prior weeks, home buyer demand has declined in response to current economic conditions. The good news is that the pending economic stimulus is on the way and will provide support for both consumers and businesses.”

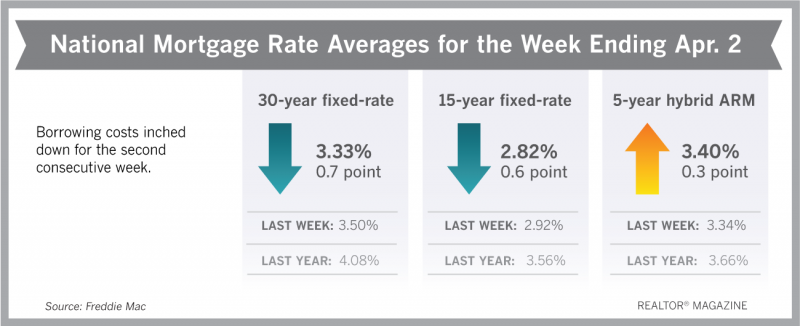

Freddie Mac reports the following national averages with mortgage rates for the week ending April 2:

- 30-year fixed-rate mortgages: averaged 3.33%, with an average 0.7 point, falling from last week’s 3.5% average. Last year at this time, 30-year rates averaged 4.08%.

- 15-year fixed-rate mortgages: averaged 2.82%, with an average 0.6 point, dropping from last week’s 2.92% average. A year ago, 15-year rates averaged 3.56%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.4%, with an average 0.3 point, rising from last week’s 3.34% average. A year ago, 5-year ARMs averaged 3.66%.

Source: Freddie Mac