The 30-year fixed-rate mortgage hit its 11th record of the year this week, averaging 2.80%—the lowest rate ever recorded by Freddie Mac.

“Mortgage rates remain very low, providing homeowners who have not already taken advantage of this environment ample opportunity to do so,” says Sam Khater, Freddie Mac’s chief economist. “Mortgage rates today are on average more than a full percentage point lower than rates over the last five years. This means that most low- and moderate-income borrowers who purchased during the last few years stand to benefit by exploring refinancing to lower their monthly payment.”

The low loan rates are fueling a hot housing market as buyers rush to lock in the rates. In September, existing-home sales jumped 21% compared to a year ago, the National Association of REALTORS® reported this week.

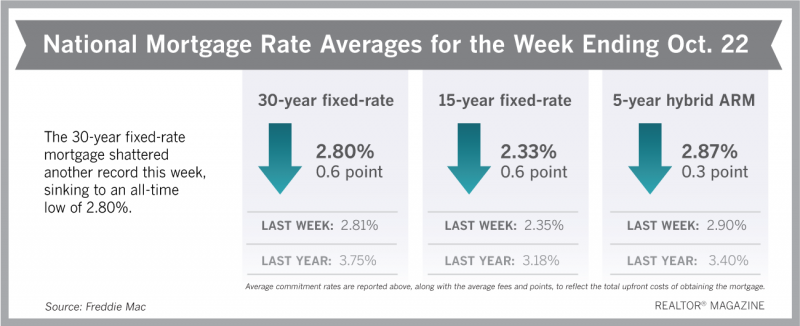

Freddie Mac reports the following national averages for mortgage rates for the week ending Oct. 22:

- 30-year fixed-rate mortgages: Averaged 2.80%, with an average 0.6 point, dropping from last week’s previous all-time low of 2.81%. Last year at this time, 30-year rates averaged 3.75%.

- 15-year fixed-rate mortgages: Averaged 2.33%, with an average 0.6 point, dropping from last week’s 2.35% average. A year ago, 15-year rates averaged 3.18%.

- 5-year hybrid adjustable-rate mortgages: Averaged 2.87%, with an average 0.3 point, falling from last week’s 2.90% average. A year ago, 5-year ARMs averaged 3.40%.

Freddie Mac reports average commitment rates along with average points to reflect the total upfront cost of obtaining a mortgage.

Source: Freddie Mac and National Association of REALTORS®