Mortgage rates were back down across the board again this week, offering some temporary relief to home buyers. Rates posted a rapid increase throughout most of the spring but have recently reversed course, declining in five of the past six weeks. The 30-year fixed-rate mortgage is now at its lowest average since April.

“The run-up in mortgage rates earlier this year represented not just a rise in risk-free borrowing costs, but for investors, the mortgage spread also rose back to more normal levels by about 20 basis points,” says Sam Khater, Freddie Mac’s chief economist. “What that means for buyers is good news. Mortgage rates may have a little more room to decline over the very short term.”

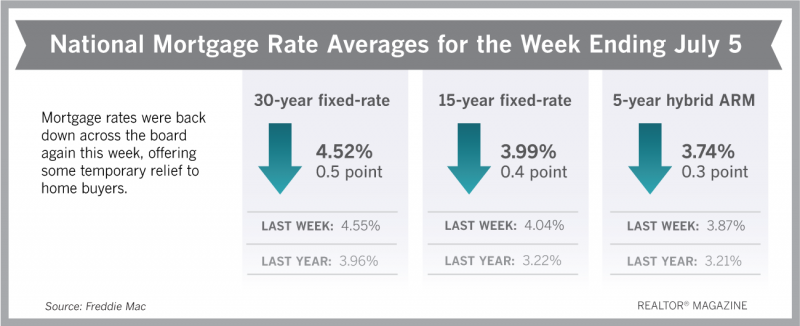

Freddie Mac reports the following national averages with mortgage rates for the week ending July 5:

- 30-year fixed-rate mortgages: averaged 4.52 percent, with an average 0.5 point, dropping from last week’s 4.55 percent average. Last year at this time, 30-year rates averaged 3.96 percent.

- 15-year fixed-rate mortgages: averaged 3.99 percent, with an average 0.4 point, falling from last week’s 4.04 percent average. A year ago, 15-year rates averaged 3.22 percent.

- 5-year hybrid adjustable-rate mortgages: averaged 3.74 percent, with an average 0.3 point, falling from last week’s 3.87 percent average. A year ago, 5-year ARMs averaged 3.21 percent.

Source: