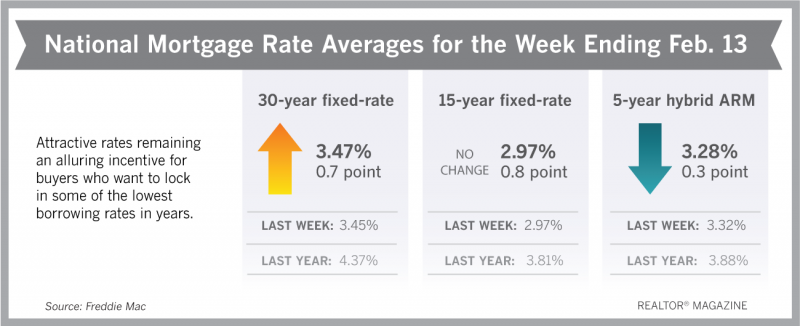

The 30-year fixed-rate mortgage averaged 3.47% this week, remaining an alluring incentive for buyers who want to lock in some of the lowest borrowing rates in years.

“With mortgage rates hovering near a five-decade low, refinance application activity is once again surging, rising to the highest level in seven years,” says Sam Khater, Freddie Mac’s chief economist. “This surge, coupled with strong purchase activity, means that total mortgage demand remains robust, reflective of a solid economic backdrop, and a very low mortgage rate environment.”

Freddie Mac reports the following national averages with mortgage rates for the week ending Feb. 13:

- 30-year fixed-rate mortgages: averaged 3.47%, with an average 0.7 point, rising slightly from last week’s 3.45% average. Last year at this time, 30-year rates averaged 4.37%.

- 15-year fixed-rate mortgages: averaged 2.97%, with an average 0.8 point, unchanged from last week. A year ago, 15-year rates averaged 3.81%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.28%, with an average 0.3 point, falling slightly from last week’s 3.32% average. A year ago, 5-year ARMs averaged 3.88%.

Source: Freddie Mac