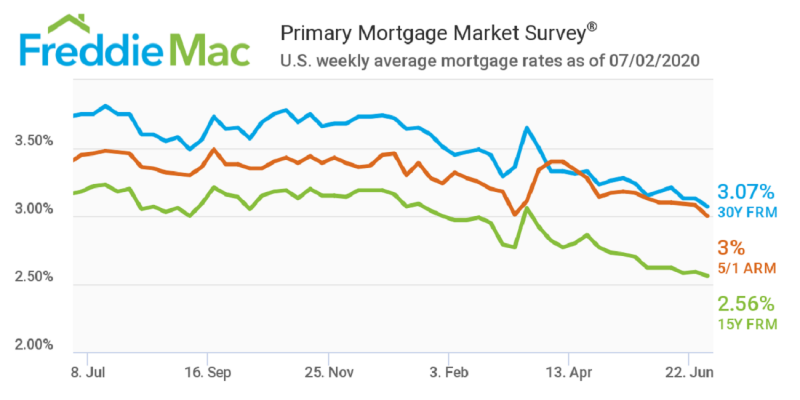

The 30-year fixed-rate mortgage averaged 3.07% this week, the lowest ever recorded by Freddie Mac since it began tracking such data in 1971. “Mortgage rates continue to slowly drift downward, with a distinct possibility that the average 30-year fixed-rate mortgage could dip below 3% later this year,” says Sam Khater, Freddie Mac’s chief economist. “On the economic front, incoming data suggest the rebound in economic activity has paused in the last couple of weeks, with modest declines in consumer spending and a pullback in purchase activity.”

Freddie Mac reported the following national averages with mortgage rates for the week ending July 2:

- 30-year fixed-rate mortgages: averaged 3.07%, with an average 0.8 point, down from last week’s 3.13%—the previous all-time low average. Last year at this time, 30-year rates averaged 3.75%.

- 15-year fixed-rate mortgages: averaged 2.56%, with an average 0.8 point, falling slightly from last week’s 2.59% average. A year ago, 15-year rates averaged 3.18%.

- 5-year hybrid adjustable-rate mortgages: averaged 3%, with an average 0.3 point, falling from last week’s 3.08% average. A year ago, 5-year ARMs averaged 3.45%.

Freddie Mac reports average commitment rates, along with average fees and points, to reflect the total upfront cost of obtaining a mortgage.

Source: Freddie Mac