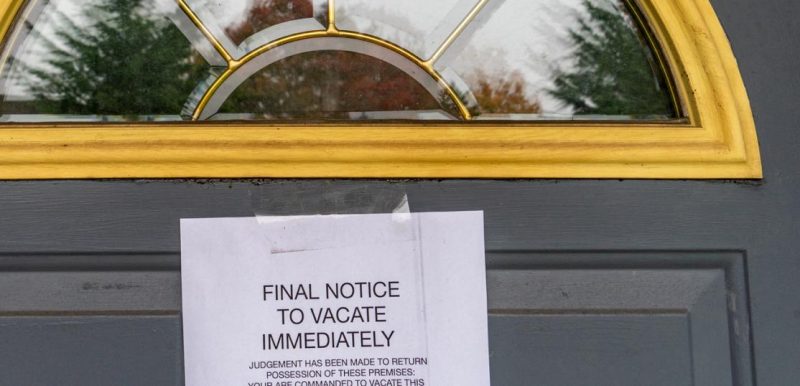

Foreclosure filings in October climbed 20% compared to September’s figures as the pandemic remains a threat to homeownership for some Americans and to the economy, ATTOM Data Solutions, a real estate research firm, reports. Foreclosure filings include default notices, scheduled auctions, or bank repossessions.

“It’s a little surprising to see foreclosure activity increasing in spite of the various foreclosure moratoria that are in place,” said Rick Sharga, executive vice president of RealtyTrac. “It’s likely that many of these properties were already in the early stages of default prior to the pandemic, or are vacant and abandoned, which makes them candidates for expedited foreclosure actions.”

Some surveys have also suggested that many struggling homeowners may be unaware of foreclosure moratoriums put in place by lenders during the pandemic that may be able to shield them from foreclosure for up to a year. Borrowers must contact their lender to initiate that, however. Read more: 400,000 Homeowners Are ‘Needlessly Delinquent,’ Study Says

The metros areas seeing the largest increases in foreclosure starts last month were New York, Chicago, Los Angeles, Miami, and Houston.

“It’s probably not a surprise that almost all of the metro areas where foreclosure activity increased on a month-over-month basis are also places where unemployment rates are higher than the national average, and in many cases have been hot spots of COVID-19 infections,” Sharga says. “Still, it’s important to keep the numbers in context—even with these increases, overall foreclosure actions are still below last year’s levels by about 80%.”

The states with the highest foreclosure rates nationwide are South Carolina, Nebraska, Alabama, Louisiana, and Florida. Broken out by metro area, the areas with the highest foreclosure rates in October were Peoria, Ill.; Champaign, Ill.; Birmingham, Ala.; and Houma, La.

A total of 6,042 U.S. properties entered the foreclosure process in October.

Source: ATTOM Data Solutions